Fraud Detection: Killing Extension To Save Time And Money Without Losing Customers

-

Oleksandr Drok

Oleksandr Drok

- Uncategorized

- 11 min read

Just imagine, how significant the retailers losses are!

So, there are 2 main categories of frauds: fraud orders and fraud returns / chargebacks. Check out their characteristics in the table below:

| Possible fraud order indicators | Possible fraud return and chargeback cases |

|

|

Now you know the common ways to play a trick on your store. Most of them are directed to get chargeback AND purchased items, and the rest to charge you even extra money. I’ll give you some practical examples 92% of online stores experience every day:

Possible Fraud Order Indicators

1. Too high subtotal orders after one or a few small ones.

This type of fraud is for really patient shopping fraudsters. First of all, the fraud registers in your store and makes a low subtotal order. This is a perfect solution to check how things work in your store: support and service team flows, checkout, payment and shipping processes. Of course, your team greets the new customer trying to please him/her and make the returning one. That’s exactly, what our fraud person needs on this step.

Then, after a little while, the fraud makes a high subtotal order. Most probably your managers will gladly send him/her purchased item(s).

What’s the trick? Everything goes OK, you could say. But wait, this isn’t it. The next step might be different, depending on fraudster goals. The can possibly:

- Say the delivery failed, he/she didn’t receive the package (but actually the package was received) and needed a chargeback.

- Say he received a package, but it was damaged and he/she needs a chargeback. But then a fraudster doesn’t send a return, even if he/she provided your managers with the shipping labels (it might be falsified), etc.

How to resolve such situations and avoid false orders?

Always verify customers identity in case you receive a high total/subtotal order, use signed delivery type for large orders and trust customers with the positive history and signed up at least a few months ago.

2. Billing and shipping addresses differ.

Fraudsters can possibly provide unequal shipping and billing addresses. This means the customer is potentially NOT the cardholder! This is the reason to investigate the order more detail.

How to resolve such situations and avoid false orders?

First of all, visualise the distance between two addresses provided in the order (use any online interactive maps). If they are located on the different continents, for instance, then the order is more likely fraudulent.

Use AVS (Address Verification System) to check the billing address of the customer, and there is any mismatches / declines, then contact the customer to reassure, whether he/she entered the data right. It’s an opportunity to find out other important details and make a decision on this order. For example, your manager could possibly hear the following explanations from the customer:

- Shipping address differs, because customer ordered a gift and wanted it to be delivered to the gift receiver directly;

- Addresses differ, because customer was shopping behalf someone else (for instance, his/her mother wanted to buy something, but wasn’t sure if she could make it the right way, so she needed some assistance).

3. IP address is not located in the shipping location.

This issue is like the previous one with different shipping and billing addresses and leads to the same consequences. Try to investigate, whether customer’s IP located in the same area, which the order was made.

How to resolve such situations and avoid false orders?

Try to investigate, whether customer’s IP located in the same area, which the order was made. Use IP locators (eg. iplocation.net, ip2location.com) for this purposes.

If it’s not, you’ve got a reason to contact a customer for more details.

4. Contact phone number is unavailable / There’s no landline number, mobile only.

Fraudsters can provide invalid phone numbers (in this case number is unavailable, whenever you try to reach it) or just a mobile number (in this case, you won’t be able to locate the number and match it to shipping / billing addresses).

How to resolve such situations and avoid false orders?

I recommend trying to reach a customer the other way (email, for instance) first, and ask him/her for the right number. Then if you succeed in reaching your buyer by the phone, ask several simple questions about order details, like shipping address, items purchased etc. and see the reaction.

If you couldn’t connect a customer, you should cancel this order and save your time and money.

5. Email address seems random.

Random email address (which consists of random symbols set, like [email protected]) is quite suspicious, if customer’s name is John Wane, for example. Admit, it would be more logical, if John Wane used an email like [email protected]?

How to resolve such situations and avoid false orders?

Contact your customer for more details and watch his/her reaction.

6. Shipping country is among potentially risky ones.

Agree, that the order from Finland is much safer than the one from Somalia? Countries like Nigeria, Libanon and many others are potentially risky ones.

How to resolve such situations and avoid false orders?

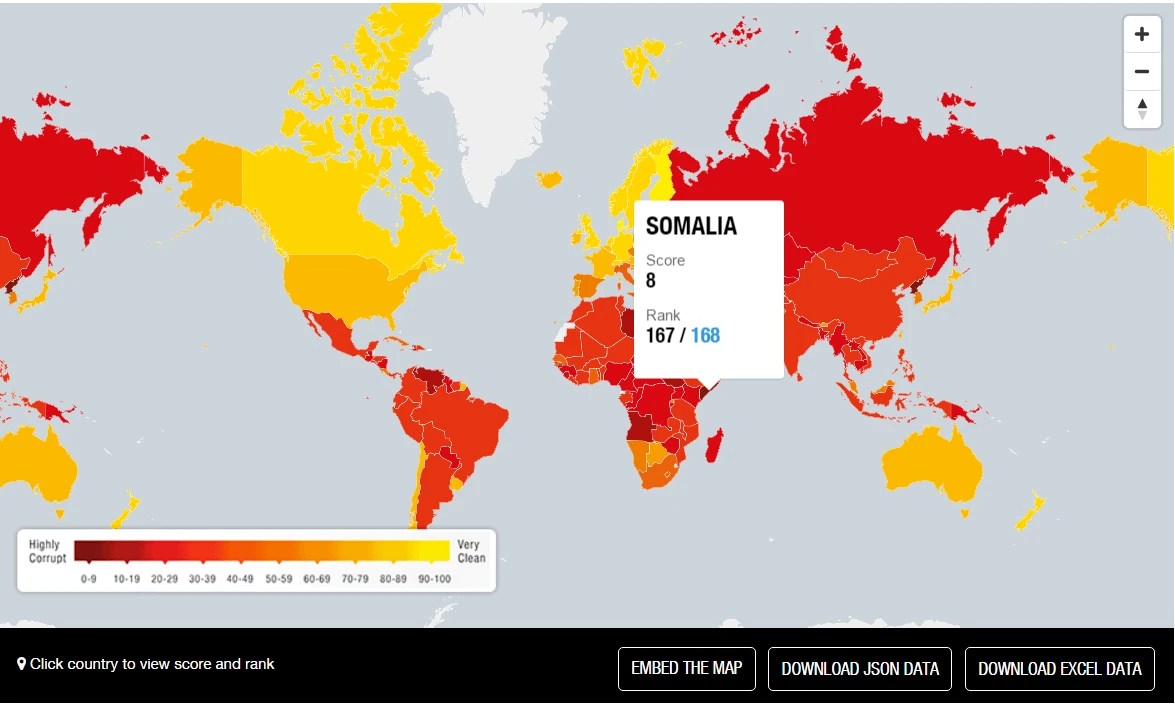

I recommend you to check every country with Transparency International and not ship to countries with the index under 60 at least.

Image 1. Transparency International Interactive Score Map

7. Customer chose the fastest and the most expensive shipping way.

If a customer choose the most expensive and fast way of delivery, this may lead to some kind of fraud either. The basic fraud idea is quite simple: there’s no time for your store managers to investigate an order – they must organize delivery in time!

How to resolve such situations and avoid false orders?

Always beware of expensive delivery orders! Check them out properly and contact every customer with such orders.

Possible Fraud Return And Chargeback Indicators1. The item is already used (“wardrobing” return).

About 72% of merchants experience wardrobing returns every year – claims National Retailers Federation.

Wardrobing means returning used stuff. For example, it’s very common, when a customer returns a dress after wearing it once for some party or prom. It’s not damaged, but it’s already used!

Or even worst, a buyer can return you a flat TV after Super Bowl ends!

How to resolve such situations and avoid fraud returns / chargebacks?

First of all, if you sell consumer electronics or home appliances (expensive products for the most part), yous should consider setting up charging restocking fee for any returns. This can help you dissuade ‘wardrobers’ from their order.

2. The item was stolen and returned.

About 92% of stores experience stolen items returns every year (nrf.com). Most probably, your shop is among them and you should know how to recognize and avoid such cases.

How to recognize stolen item returns? Short checklist:

- All receipts (e-receipts) should be attached.

- Returning address and shipping address should be equal.

- Cardholder’s name of buyer and returner should match.

- Contacts (phone number, email etc.) should be the same for the receiver and returner.

How to resolve such situations and avoid fraud returns / chargebacks?

Charge some fee for returns (like mentioned in the previous case), first of all. Then if you’ve got a retail shop (offine one) in addition to your online store, consider setting up the policy of returns to your offline store. This way your managers will be able to recognize the thief at once and react immediately.

3. Employee return fraud or collusion with external forces.

The order was obviously fraudulent, but the store manager decided to send it anyway. Then he/she (the same manager) received a chargeback request on some reason and approved it. Chargebacked money was shared between fraudsters.

About 78% of merchants experience such situations every year, according to NRF.

How to resolve such situations and avoid fraud returns / chargebacks?

First of all, track returns on a regular basis: maybe there is an employee who receives more returns / chargebacks inquiries than the others? Or maybe there is a customer who returns too often?

Be aware and stay close to your shop analytics.

4. Used gift card or store credits return.

Fraudsters buy some products with gift cards, then return the items and require a chargeback. Or customer can ask for gift receipts for “final sale” products, so he/she can return them for store credit.

Almost 61% of merchant noticed an increase in such frauds, according to nrf.com.

How to resolve such situations and avoid fraud returns / chargebacks?

Include in your Return Policy a rule: NO returns for orders with gift cards used! This way you will prevent the most issues with this type of fraud chargebacks.

5. No receipt or e-receipt.

10% of returns without any receipt are fraudulent and 85% of merchants require customer identification in case of returns without receipt, claims National Retailers Federation.

How to resolve such situations and avoid fraud returns / chargebacks?

Using digitized receipts anyhow is safer than the paper ones, which are easy to lose. Your employees can access them online and verify the purchase was actually made and what form of payment was used.

6. Falsified receipt.

A customer can make a copy of your store receipt in order to change an order total or date.

How to resolve such situations and avoid fraud returns / chargebacks?

Use e-receipts and your support and service team members will always be able to check them online.

SOLUTION

Mirasvit realized all abovementioned issues with fraud orders, returns / chargebacks, and released the perfect solution – Fraud Detection extension, which could help you to save your money, time, avoiding legitimate customers losses.

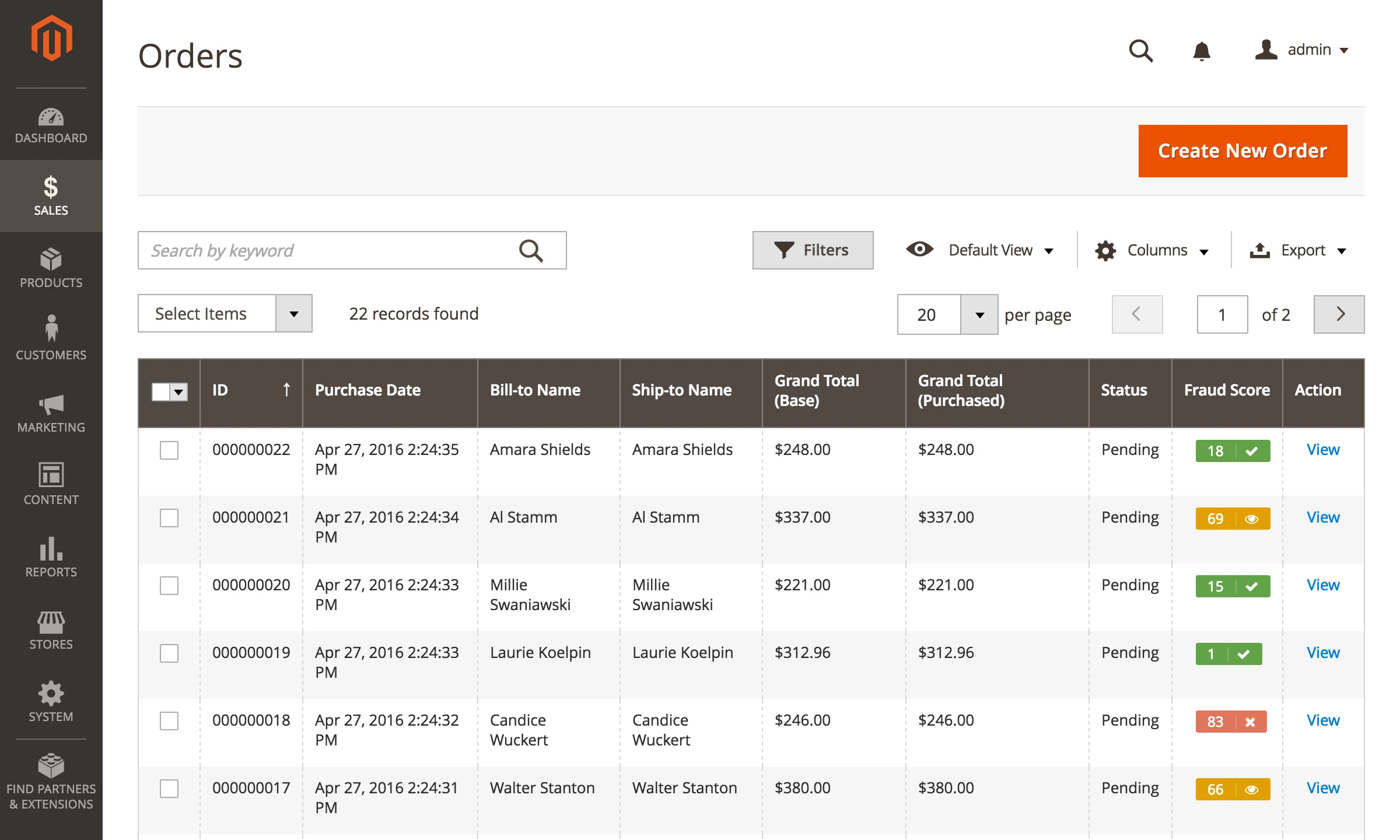

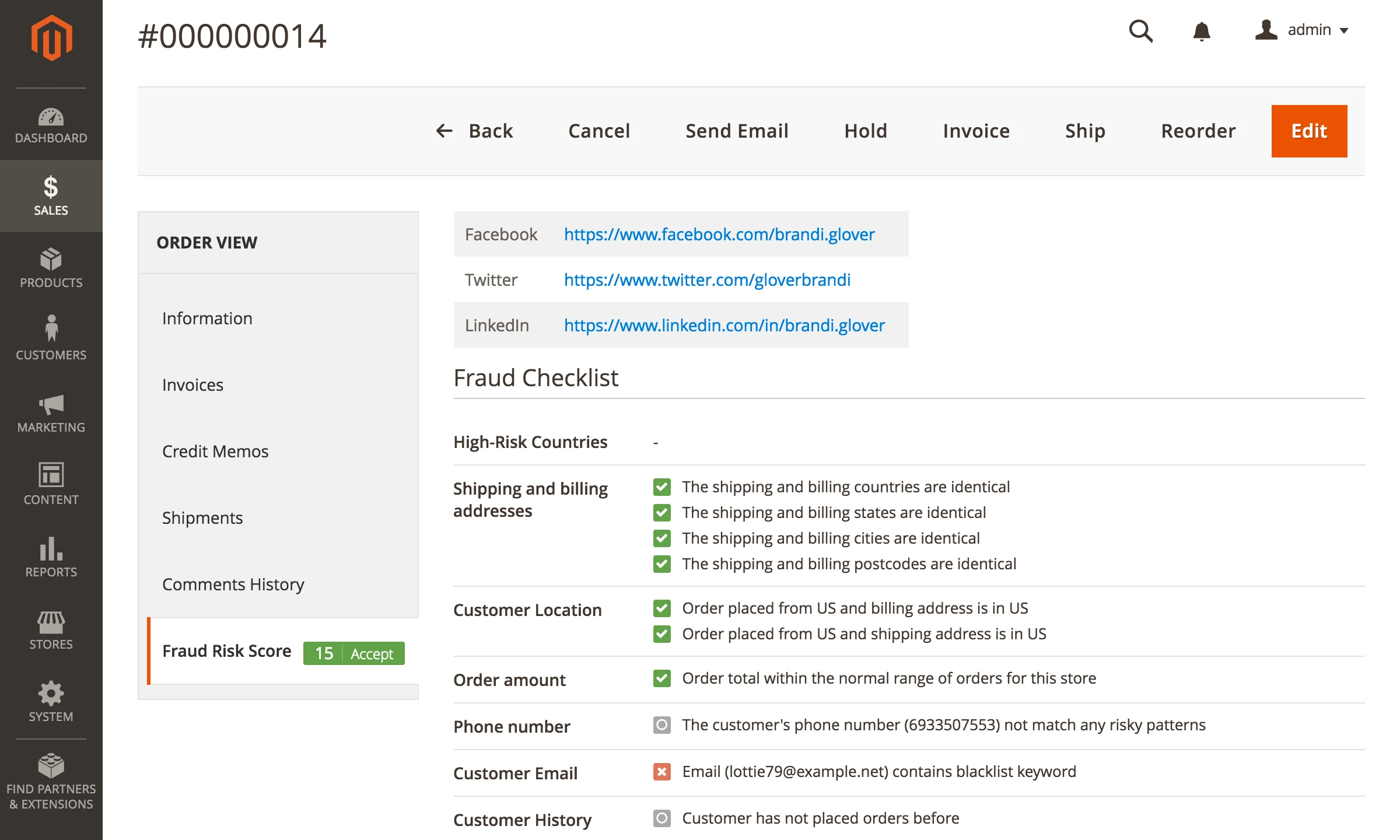

Fraud Detection scores every order and your store manager can make a decision, basing on preliminary fraud risk score, whether investigate this order, approve or cancel it.

Mirasvit Fraud Detection covers the following support and service team members needs:

Weigh potential risk of each order quickly.

Extension provides your store managers with visual and numerical information regarding frauds risk. Responsible team member can weigh each case at a glance, since there are 3 colors for fraud score (RED – pay attention and investigate immediately or even cancel it, YELLOW – it’s OK in general, but take a look at some secondary details, GREEN – everything is great, the order is clean, approve it) and the points number (the lower this number is, the better).

Image 2. Orders Fraud Risk Score at a glance.

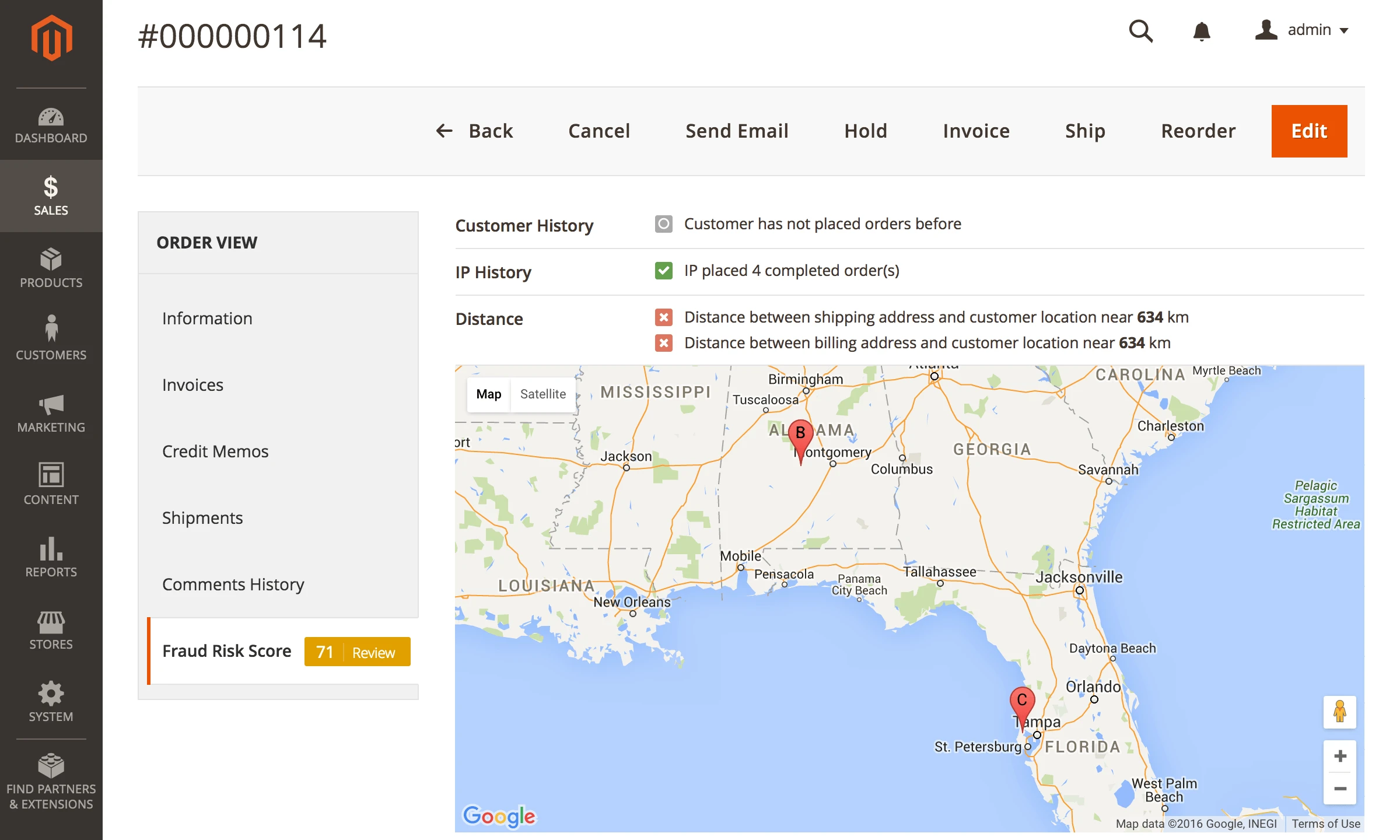

Visualising Shipping and Billing addresses.

One of the most important and easy to check indicators is matching shipping and billing addresses. Fraud Detection allows you to see both of them right on Google maps!

Furthermore, you’ll be able to track IP history and match it to customer’s history.

Image 3. Map of Shipping and Billing addresses locations.

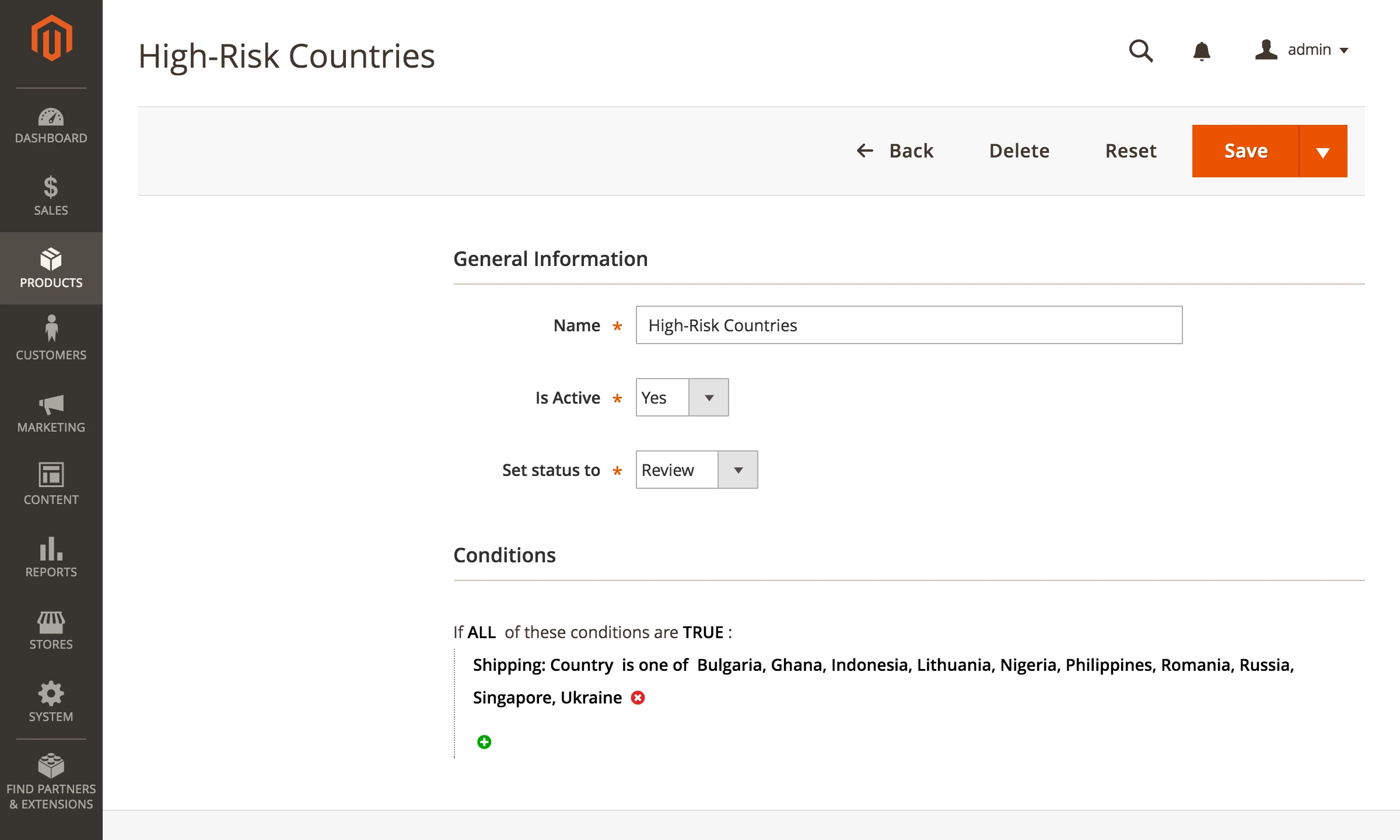

Define High-Risk Countries Yourself

High-risk countries definition might be quite obscure. For some stores high-risk country is just the one situated more than 500 miles away, for the other – any country from the certain continent, etc.

Fraud Detection allows you to manage such locations yourself – just activate this feature and list desired countries. Since then, this factor will add some risk points to orders from listed locations.

Image 4. Setting up High-Risk countries.

Image 4. Setting up High-Risk countries.

Investigate customer’s profile

When it comes to order review, your store manager will investigate customer’s profile. Fraud Detection gives you an opportunity to get the following insights:

- View Facebook, Twitter, LinkedIn profiles;

- Explore shipping and billing addresses from the different points of view;

- Compare current order total to your store average;

- Match phone number with risky patterns;

- Check if email address contains any blacklist keywords;

- View if customer made some purchases before.

Image 5. Explore customer social accounts

Image 5. Explore customer social accounts

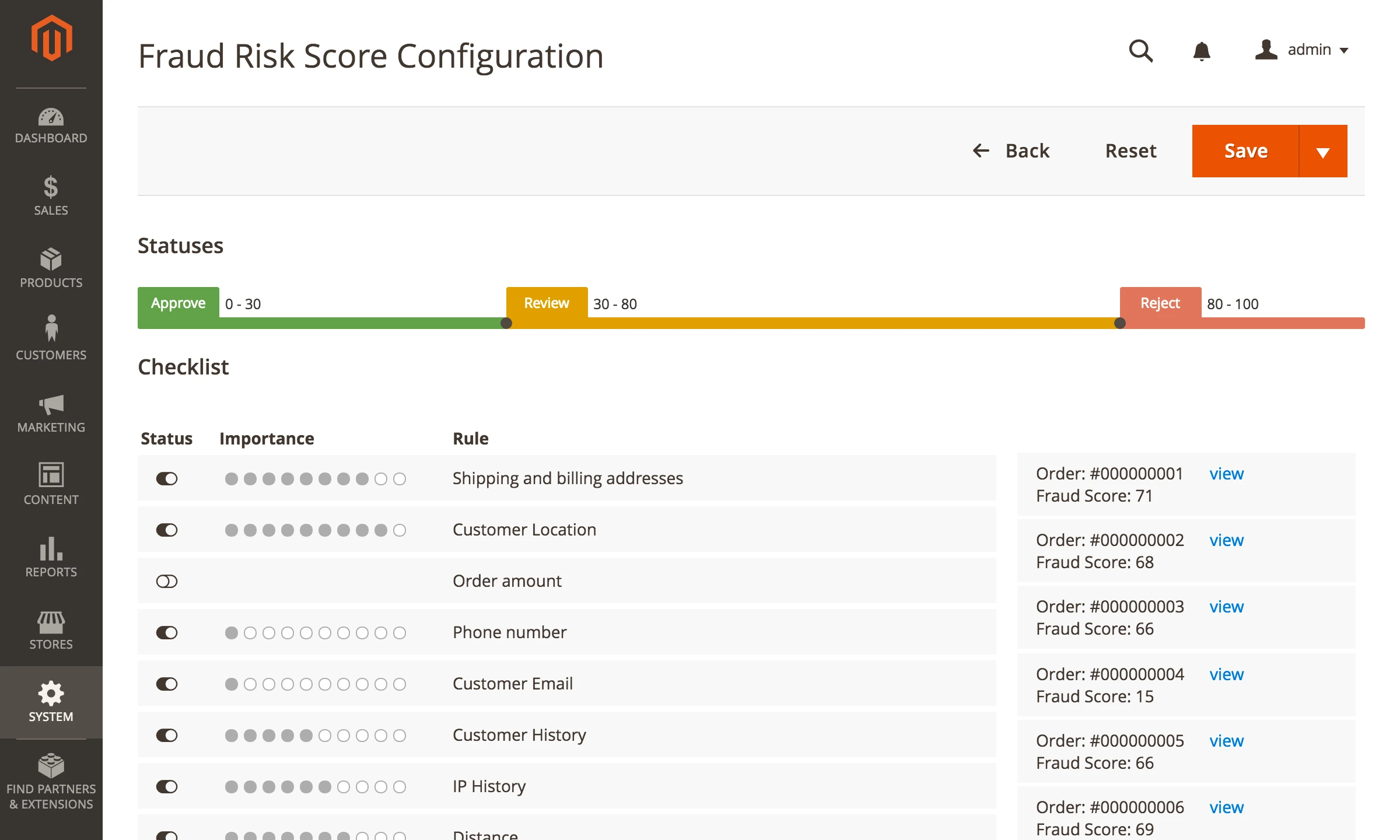

Manage risks scoring depending on business model and working flows

It’s really vital for any extension to comply with your store business model and flows. Fraud Detection is enough flexible to match any store model and processes.

Mirasvit solution allows to set and change risk scores for every factor any time you need. Activate / deactivate and change weight for the following factors:

- Shipping and billing addresses;

- Customer location;

- Email;

- Phone number;

- IP;

- Orders history etc.

Image 6. Setting up the weight of each risk factor.

SUMMARY

Orders, Returns / Chargebacks Frauds remain the critical issue for every retailer and/or online store owner. Every merchant tries to find the best way to prevent all types of fraud. And Mirasvit suggests Magento 2 store owners the prominent solution: Fraud Detection extension, which gives your shop several great opportunities:

- Avoid canceling legitimate orders.

- Cancel suspicious transactions fast.

- Use human factor pros: get fraud risk score and decide whether review an order or simply cancel it.

- Configure extension settings to comply with your business model.

- View the physical map of customer destination country and estimate location risks visually.

- Get the deepest insight about your customers including their Facebook, Twitter and LinkedIn profiles.

- Automate a huge scope of your team work and save time!